Articles of Association

1 Company’s business name and domicile

The company’s business name is Alisa Pankki Oyj in Finnish, Alisa Bank Abp in Swedish and Alisa Bank Plc in English.

The company is domiciled in Helsinki.

2 Line of business

The company engages in activities permissible to a deposit bank as a commercial bank as defined in the Act on Credit Institutions. As the Group’s parent company, the company is responsible for the management, control and risk management of the Group and provides Group services to its subsidiaries.

3 Board of Directors and Chairman of the Board

The company’s Board of Directors shall consist of at least four (4) and at most eight (8) regular members whose term shall expire at the close of the Annual General Meeting that follows their election.

The General Meeting that decides on the election of the Board of Directors elects the Chairman and Deputy Chairman of the Board of Directors.

4 CEO

The company has a CEO and a Deputy CEO elected by the Board of Directors.

5 Representing the company

The company is represented by the members of the Board and the CEO two together.

The Board of Directors may grant a nominee a procuration or right to represent the company together with a member of the Board, the CEO or another person entitled to represent the company.

6 Financial year

The company’s financial year shall be the calendar year.

7 Auditor

The company has one auditor who must be an audit firm approved by the Finnish Patent and Registration Office, and the principally responsible auditor must be an Authorized Public Accountant.

The auditor’s term ends at the close of the Annual General Meeting following the election of the auditor.

8 Notice of the general meeting

A notice of the general meeting shall be published on the company’s website no earlier than three (3) months and no later than three (3) weeks before the general meeting, however, no later than nine (9) days before the record date of the general meeting.

9 Registration to attend

In order to be able to participate in the general meeting, shareholders must notify the company of this no later than on the date specified on the notice of the general meeting, which may be no earlier than ten days before the general meeting.

10 Annual General Meeting

The Annual General Meeting shall be held annually on a date determined by the Board of Directors, and no later than six months after the end of the financial year.

The Annual General Meeting shall decide on:

1. the adoption of the financial statements and consolidated financial statements

2. the use of the profit shown in the balance sheet

3. discharging the Board members, the CEO and the Deputy CEO from liability

4. the number of members of the Board, their remuneration and their election

5. the appointment and fees of the auditor

6. the approval of remuneration policy, if necessary

7. the approval of the remuneration report

8. other matters to be discussed at the meeting according to the notice to the meeting.

The Board of Directors can also decide that the General Meeting is organized without a meeting place, so that the shareholders exercise their decision-making power during the meeting in full and up-to-date with the help of a data communication connection and a technical aid.

11 Book-entry system

The company’s shares are registered in the book-entry system.

General Meeting

Alisa Bank’s highest decision-making power is exercised by the shareholders at the General Meeting and it meets regularly at least once a year. The Annual General Meeting is held upon completion of the company’s financial statements, at a place and on a date designated by the Board of Directors. The date must be no later than the end of June. An Extraordinary General Meeting will be convened if necessary.

Matters within the decision-making power of the General Meeting

The General Meeting discusses matters according to the Articles of Association and the Limited Liability Companies Act. The Annual General Meeting decides on matters such as:

- Adoption of the financial statements

- Use of the profit shown in the balance sheet

- Discharging the Board members and CEO from liability

- Remuneration of the Board of Directors and the auditor

- Number of Board members

- Amending the Articles of Association and increasing the share capital or granting the necessary authorisation to do so.

The General Meeting also elects the members of the Board of Directors and the auditor. The General Meeting also discusses other matters and presents the company’s financial statements, the Board of Directors’ report and auditor’s report.

Convening and documentation

The notice of the General Meeting and the documents related to the General Meeting are published on Alisa Bank’s website and as a stock exchange release no earlier than three (3) months before the record date of the General Meeting, and no later than three (3) weeks before the General Meeting, however, no later than nine (9) days before the record date of the General Meeting. The Board of Directors may also decide to announce the General Meeting in one or more newspapers.

The minutes of the General Meeting and any voting results and appendices related to the decisions of the General Meeting will be published on the company’s website for the shareholders to view within two weeks of the General Meeting.

Extraordinary General Meeting 2025

Board of Directors

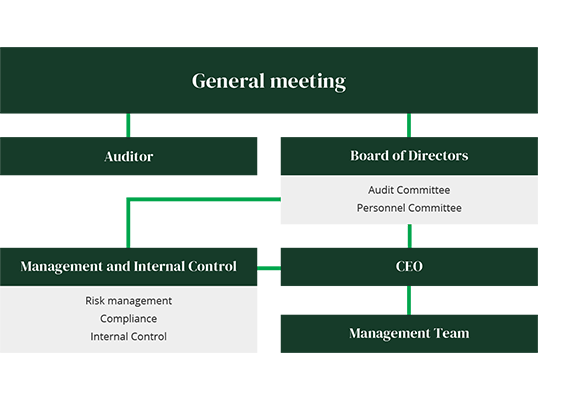

The Board of Directors of Alisa Bank Plc is responsible for the company’s administration and appropriate organization of operations. The Board of Directors confirms the principles concerning the company's strategy, organisation, accounting and asset management control, and appoints the company’s CEO. The Board has approved a written charter, which defines the matters to be dealt with by the Board.

Under the Articles of Association, the Board of Directors of Alisa Bank Plc consists of 4–8 members. The general meeting decides on the number of members and elects the members from among representatives of major shareholders and external independent experts who have varied experience in business and the sector. The members of the Board of Directors are elected for one year at a time.

The Board has established an Audit Committee and Personnel Committee to prepare matters to be handled by the Board. The committees have no independent decision-making power; instead, decisions are made by the Board on the basis of recommendations and information supplied by the committees. The committees make regular reports on their activities to the Board. The Board has approved written charters for the committees that provide more detailed guidance on their work.

Audit Committee

The Audit Committee is responsible for assisting the Board of Directors in ensuring that the company has an adequate internal control system covering all operations and that the company’s risk management has been arranged appropriately, and it also monitors the financial statements reporting process.

The members of the Audit Committee are Sami Honkonen, Marjo Tomminen and Johanna Lamminen as the Chairman.

Personnel Committee

The Personnel Committee, which also acts as the Compensation Committee, is responsible for assisting the company's Board in the preparation of matters related to the terms of employment and remuneration of management and employees. The Personnel Committee monitors and assesses the company’s wellbeing at work, personnel satisfaction and development.

The members of the Personnel Committee are Tero Weckroth, Peter Ramsay and Karri Haaparinne as the Chairman.

CEO and Management Team

The CEO of Alisa Bank is in charge of the day-to-day management of the company in accordance with the instructions and orders issued by the Board of Directors. The Group’s Management Team assists the CEO in the operative management of the company. Alisa Bank’s Board appoints the company’s CEO and decides on the terms of the employment relationship. The Board also confirms the members of the Management Team based on the CEO’s proposal.

The CEO’s duties include the management and supervision of the Group’s business, preparation of matters to be handled by the Board, and implementation of the Board’s decisions. In accordance with the Limited Liability Companies Act, the CEO is responsible for ensuring that the company’s accounting practices are in compliance with the law and that the financial matters are organized in a reliable manner.

The Management Team assists the CEO in business development and operational management. The company’s Board also confirms the members of the Management Team based on the CEO’s proposal.

Nomination Board of Shareholders

The Shareholders’ Nomination Board of Alisa Bank prepares proposals for the Annual General Meeting concerning the election and remuneration of the members of the Board of Directors.

According to the procedure of the Nomination Board of Shareholders, each of the four largest shareholders of Alisa Bank appoint a member to the Nomination Board of Shareholder. Being entitled to appoint a member is based on Alisa Bank Shareholder Register maintained by Euroclear Finland Ltd. on the last working day of August each year.

Composition of the Nomination Board from 8 October 2025:

- Maunu Lehtimäki, appointed by Evli Oyj with 15 288 303 shares

- Juhani Elomaa, appointed by Taaleri Oyj with 15 288 303 shares

- Antti Kemppi, appointed by Kempinvest Oy with 13 392 003 shares

- Mika Laine, appointed by Mika Laine/Veikko Laine Oy with 8 587 789 shares

Maunu Lehtimäki has been elected as a Chairman of the Nomination Board. In addition, the Chairman of the Board of Directors of Alisa Bank serves as an expert in the Nomination Board without being a member.

Risk Management and Internal Control

Alisa Bank’s values and its policy of transparent and appropriate communications support the company’s operational integrity and high ethical standards. The company’s organisational structure, clearly established responsibilities and authorisations, and its competent personnel support the planning, execution, control, and monitoring of business operations in a manner that facilitates the achievement of set targets.

Risk management refers to actions aimed at systematically surveying, identifying, analyzing and preventing risks. The objective of risk management is to:

- Ensure the sufficiency of our own assets in relation to risk positions.

- Ensure that fluctuations in financial results and valuations remain within the confirmed targets and limits.

- Price risks correctly to achieve sustainable profitability.

- Support the uninterrupted implementation of the Group’s strategy and income generation.

Alisa Bank defines risk as an event or series of events that jeopardize the company’s income generation over the short or long term.

Alisa Bank’s Board of Directors is primarily responsible for the Alisa Bank Group’s risk management. Alisa Bank’s Board of Directors confirms the principles and responsibilities of risk management, the risk limits of the Group and other general guidelines according to which the risk management and internal audit are organized. The Board has also set up a credit and risk control committee that briefs the Board on risk-taking proposals.

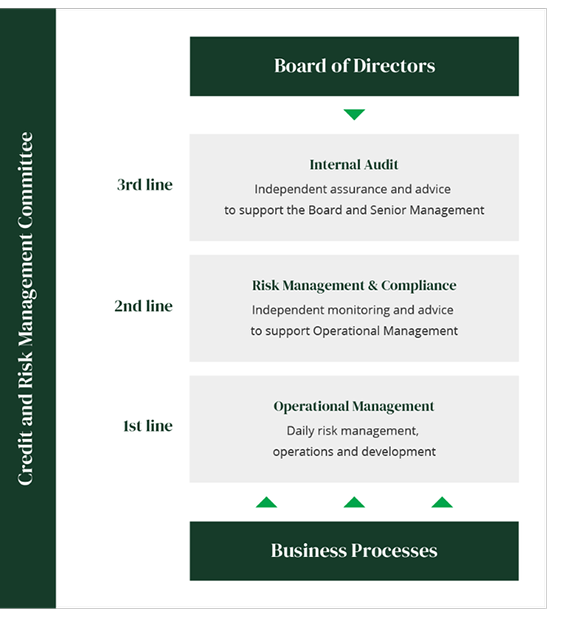

In addition to the general principles of risk management, the Alisa Bank Group’s risk management is founded on the principle of three lines of defense.

Lines of defense for internal control and risk management

First line of defense – Business units

Risk management is a part of internal control, and therefore the responsibility for executing risk management measures lies first with the business units, as the first line of defense. The managers of the business units are responsible for ensuring that risk management is at a sufficient level in each respective unit. The task of business units is to:

- Build the processes and competence for risk management and internal control.

- Identify and analyze risks.

- Make decisions on risk management by means of various protection measures.

- Build the processes and competence for risk management and internal control with various protection measures.

Second line of defense – Risk Management and Compliance functions

The second line of defense comprises the independent Risk Management and Compliance functions whose primary task is to develop, maintain and oversee the general principles and framework of risk management.

The Risk Management function oversees daily operations and compliance with the risk limits granted to the business units, as well as compliance with risk-taking policies and guidelines. Risk Management reports on the Alisa Bank Group’s overall risk position to the Board and the Management Team each month.

The Compliance function is responsible for ensuring compliance with the rules in all of the Alisa Bank Group’s operations by supporting operating management and the business units in applying the provisions of the law, the official regulations and internal guidelines, and in identifying, managing and reporting on any risks of insufficient compliance with the rules in accordance with the separate compliance policy and monitoring plan confirmed by Alisa Bank’s Board of Directors. The Compliance function reports regularly via the Audit Committee to Alisa Bank’s Board and also to the operating management.

Third line of defense – Internal audit

The third line of defense is internal audit. The internal audit is a support function for the Board of Directors and senior management that is independent of the business functions. It is administratively subordinate to the CEO and reports to the CEO and, via the Audit Committee, to the Board of Alisa Bank.

The internal audit assesses the functioning of the Alisa Bank Group’s internal control system, the appropriateness and efficiency of the functions and compliance with instructions. It does this by means of inspections that are based on the internal audit action plan adopted annually by the Audit Committee of the Board of Alisa Bank.

Internal audit follows not only the internal audit guidelines, but also the internationally acknowledged framework of professional practices (The Institute of Internal Auditors) and corresponding guidelines on information systems audit standards (The Information Systems Audit and Control Association).

Audit

The company has one auditor who must be an audit firm approved by the Finnish Patent and Registration Office, and the principally responsible auditor must be an Authorized Public Accountant. The auditor’s term ends at the close of the Annual General Meeting following the election of the auditor.

The Annual General Meeting held on 20 March 2025 elected auditing firm KPMG Oy Ab as the Auditor, with APA Tiia Kataja as the principal auditor.

The auditor issues the company’s shareholders with a statutory auditor’s report in connection with the company’s annual financial statements. The purpose of the audit is to ensure that Alisa Bank's financial statements and Board of Directors’ report provide true and fair information on the company's financial results and financial position. The audit also includes auditing the accounting and administration of Alisa Bank. The statutory auditor’s report is sent to shareholders in connection with the company's financial statements. The auditors report their observations regularly to the Audit Committee and at least once a year to the Board of Directors.

In 2024, the audit firms were paid fees totaling EUR 0.2 million. The fees for auditing came to EUR 0.2 million and the non-audit advisory service fees came to EUR 0.0 million. The company also occasionally purchases consultancy services from the audit firm. The independence of this work from auditing is assessed by the Board.

Corporate Governance Statement

Alisa Bank publishes a Corporate Governance Statement every year. Corporate Governance Statements by Fellow Finance and Evli Bank are located here.

Remuneration

Every year, Alisa Bank publishes a separate remuneration report for governing bodies, which describes remuneration in more detail.

Alisa Bank's remuneration statements for previous years can be found here, and Evli Bank’s remuneration reports and remuneration statements can be found here.

Alisa Bank’s remuneration model

The remuneration model of Alisa Bank Plc describes the company's remuneration practices. The objective of the model is to support the implementation of the company's strategy and to promote its competitiveness and the long-term financial performance. A further aim is to contribute to a positive trend in shareholder value and to commit the company’s employees to the company’s objectives in the long run. The remuneration model consists of fixed salaries and other fees and variable remuneration, including a long-term incentive programme for key employees, and short-term remuneration systems.

Decision-making relating to remuneration

The Personnel Committee, appointed by the Board of Directors from among its membership, together with the management, draws up a remuneration model based on the objectives set by the Board of Directors, which defines the Alisa Bank's variable remuneration. The Board of Directors discusses and approves the remuneration model annually. The Board also decides on long-term incentive programmes and share-based incentives.

The remuneration model is subject to applicable remuneration legislation and regulatory guidelines. The functioning of the remuneration model and its results are monitored by the Personnel Committee. The Personnel Committee also monitors compliance with the remuneration model and the remuneration of the company's risk takers and those in charge of risk monitoring and other monitoring duties. The company's internal audit function conducts an annual audit of remuneration.

Alisa Bank Plc’s general meeting decides on the remuneration of the members of the Board of Directors, and the major shareholders are responsible for preparing the proposal regarding the remuneration.

The principles and elements of the remuneration of the CEO and the Management Team are confirmed by the Board of Directors of Alisa Bank. The Board's Personnel Committee prepares proposals on matters related to remuneration for decision-making by the Board. All changes to the CEO's salary and remuneration are subject to approval by the Board of Directors.

Key principles of remuneration

Fixed salaries and fees

Fixed salaries play an important role in the company. By aiming to offer its employees a competitive pay level, the company ensures that it continues to be staffed by a skilled workforce. Fixed salaries rise either on the basis of increases in accordance with collective bargaining or on the basis of a personal increment made by the employee’s supervisor. The Group does not have other substantial fringe benefits.

Variable remuneration

Alisa Bank’s remuneration model covers the Group’s entire staff. The objective of remuneration is to support the implementation of the company’s strategy as well as to promote its competitiveness and long-term financial performance. Remuneration in accordance with the remuneration model is tied to the financial performance of the entire Group, compliance with the company's operating principles and guidelines, and ensuring capital adequacy. The remuneration model also takes sustainability risks into account when evaluating performance on the individual and team level and discourages unhealthy risk-taking.

Remuneration in accordance with the remuneration model is always conditional based on the Board of Directors’ discretion. If deemed pertinent, the company may, by a decision of the Board of Directors, decide not to pay the variable bonus, in whole or in part. The company shall also always have the right to claw back a variable bonus already paid if, after such payment, it becomes apparent that the person receiving the bonus has endangered the financial position of the company, violated the company's operating principles and practices, or contributed to such conduct through neglect.

Alisa Bank’s remuneration model contains limitations that are there to ensure that a variable salary component is not paid if the Group’s profit performance is not favourable. The basis for remuneration is a result which is strong enough to ensure that the company’s capital adequacy is not affected by the variable remuneration. The remuneration model also contains limitations to ensure that the ratio of variable remuneration to fixed salaries is never able to increase to a level that would encourage unhealthy risk-taking. For each individual, the share of the variable pay component must not exceed 100 per cent of the total fixed salary element, unless the Annual General Meeting decides otherwise.

Disclosure Policy

Alisa Bank Plc complies with EU legislation, including the Market Abuse Regulation (MAR), Finnish legislation, Nasdaq Helsinki Ltd’s guidelines, and other relevant regulations and guidelines. These have been supplemented by the company's own disclosure policy approved by the Board of Directors.

Alisa Bank's disclosure policy describes the key principles that the company follows in its investor communications and financial reporting, and in its communications with its shareholders and other capital market parties, the media and other stakeholders. This is a summary of the main points of the disclosure policy.

Objectives and key principles

The purpose of Alisa Bank's disclosure policy is to ensure that all market participants have at their disposal at the same time and without delay coherent, relevant and sufficient information on factors affecting the value of Alisa Bank’s share. All communications are also based on the values of Alisa Bank and the company's own governance principles.

When disclosing information to the market, Alisa Bank complies with the following principles:

- information must be factual;

- information is disclosed without delay;

- communications are consistent and precise; and

- communications are fair and transparent.

Financial reporting

Alisa Bank prepares its regularly published financial reports in accordance with the IFRS standards. Alisa Bank reports on the Group level. Alisa Bank regularly reports about the company’s financial performance, development of profitability, balance sheet status and financial status and outlook on the operational performance of its businesses. This information is mainly published in the financial statements bulletin and half-year report. Alisa Bank also publishes the financial statements, the Board of Directors’ report and the auditor’s report, the corporate governance statement and a remuneration statement that can be combined with the company’s annual report.

The annual report will be published annually no later than three weeks before the Annual General Meeting. The audited consolidated financial statements are available on Alisa Bank’s website www.alisabank.com no later than three weeks before the Annual General Meeting.

Alisa Bank publishes its financial reports according to a timetable announced in advance. The publication dates for the financial year are published before the beginning of each financial year.

Financial targets and performance guidance

In connection with the strategy process, the Board of Directors of Alisa Bank determines the company's financial targets and assesses the need for changes. Changes in financial targets are notified with stock exchange releases or in conjunction with interim reports.

Alisa Bank reports about its outlook by giving an annual estimate of probable future developments in the Board of Directors’ report, which is announced with a stock exchange release. Alisa Bank also evaluates its future development in interim reports and financial statements bulletins. Because of the poor predictability of the financial markets, the company does not give detailed earnings forecasts, but strives to provide a general picture of the future outlook to the best of its ability.

Profit warnings

Alisa Bank will publish a profit warning without delay if the company is of the opinion that its financial position and/or future outlook will diverge substantially, either positively or negatively, from information published by the company earlier, and such a divergence may have a material effect on the value of the company’s share.

Silent period

Financial reports published regularly are always preceded by a silent period that starts 30 days before the date of publication of the next financial report. During this period, Alisa Bank does not provide any comments on the company’s financial status, markets, or future outlook. During the silent period, the representatives of the Group’s senior management do not meet investors, analysts, or other market operators, and do not give interviews regarding the company’s financial status. The dates of the profit reporting and silent periods are published in the investor calendar on Alisa Bank’s website.

If an event during the silent period requires immediate publication, Alisa Bank will publish the information without delay in accordance with regulations regarding the disclosure obligation, and may comment on the event in question.

Distribution channels and availability of information

Alisa Bank’s main distribution channel for investor information is the company’s website www.alisabank.com, which is equally available to all investors. The purpose of the website’s investors section is to distribute correct and up-to-date information on Alisa Bank as an investment, and it is divided into several subsections. The investors section contains information intended for shareholders and analysts about the company’s shares, financial performance, ownership and administration, and other materials for investors. The company also publishes the information it uses at investor and analyst meetings on its website.

Alisa Bank's stock exchange releases are published through an information distribution service (which requires distribution in Nasdaq Helsinki and the main media, for example) and on the company's website www.alisabank.com. The company’s press releases are published in an information distribution service and on the company's website. Releases are available on the company's website for at least five years, and financial and other reports are subject to a regular disclosure obligation for at least ten years.

Alisa Bank’s official reporting language is Finnish. All releases and financial reports that fall within the scope of the disclosure obligation are also published in English.

Deviation from the disclosure policy

Within the framework of applicable laws and regulations, the company is entitled, under special circumstances, for weighty reasons, to deviate from the disclosure policy, in which case the company’s CEO will decide on the deviation.

Related Party Transactions

The related parties of Alisa Bank Plc are defined in accordance with the international accounting standard IAS 24 and credit institution regulation. Related parties include the company's subsidiaries, members of the parent company's Board of Directors and Management Team, and persons and companies that are closely associated with them. The company maintains and regularly updates a register of its related parties in order to identify the related party transactions. A related party transaction is a transaction between Alisa Bank Plc and a party that is a related party.

All transactions with related parties and any relevant decisions are made in accordance with the company's related party procedures. The Board of Directors of Alisa Bank Plc decides on related party transactions that deviate from the company's normal business operations or are carried out under conditions other than normal market conditions. Information on related party transactions for each financial year can be found in the notes to the Alisa Bank Plc’s financial statements. In addition, Alisa Bank Plc discloses related party transactions separately if legislation or Nasdaq Helsinki Ltd's regulations so direct.

Insider Administration

Alisa Bank Plc complies with EU legislation, especially the Market Abuse Regulation (MAR), Finnish legislation, Nasdaq Helsinki Ltd’s Guidelines for Insiders, and other relevant regulations and guidelines. These have been supplemented by the company's own insider guidelines approved by the Board of Directors. The company’s insider administration monitors compliance with the rules.

Alisa Bank maintains registers of project-specific and transaction-specific insiders that are required at any given time.

Trading restrictions

The persons defined in the insider guidelines shall comply with the restrictions that apply to them regarding the use of insider information and trading. Such persons may not trade in financial instruments issued by the company for 30 days before the publication of an interim report or the financial statements bulletin (closed period).

Managers and their announcements

The company has specified that its managers include the members of the Board of Directors and the company's other top management. Alisa Bank has also specified that these persons and their related parties are obliged to disclose their business transactions with Alisa Bank Plc’s financial instruments.

Both managers and their related parties must report all transactions related to the company's financial instruments within two working days of their payment. The company reports transactions of the management and their related parties with stock exchange releases.